Wise Spending of Your Federal Relief Funds

August 01, 2021

Who decides how to spend the money generated by the American Rescue Plan? Districts do, and it’s a huge responsibility.

Hours after the American Rescue Plan was signed into law in March, we started hearing from overwhelmed school district leaders with urgent financial questions: “What if we can’t spend all this money by the deadline?” and “How do

I write a budget for federal dollars that just quadrupled?” And this one: “What exactly do they want us to do with this money?”

One message simply said, “HELP!”

Even seasoned education leaders were

facing financial conditions they’d never before seen. The federal funding is highly flexible, meaning school districts face important decisions on how to spend it. That flexibility is both a blessing and a challenge as intense planning is involved

in making decisions about how to use flexible funds.

In response, the Edunomics Lab, a Georgetown University research center modeling complex education finance decisions, released a set of principles to guide spending decisions. In the hurried months since the bill passed, districts have worked at warp speed to craft interim budgets, pencil out costs, vet contractors and respond to state and federal requests for information, all in the midst of the annual

budget cycle and contract negotiations.

Even so, countless unknowns linger: How will state funding play out? How many students will come back to school? And the most vexing: How deep are the learning gaps and what investments will best

address them?

As the calendar turns to fall, now is a good time for school district leaders to step back and take stock of where things stand. These five key questions can help district leaders ensure they make the most of their federal

dollars.

This Content is Exclusive to Members

AASA Member? Login to Access the Full Resource

Not a Member? Join Now | Learn More About Membership

School districts can use new school-by-school financials to determine the equity implications across schools.

School districts can use new school-by-school financials to determine the equity implications across schools.Because all states now report school-by-school expenditures each year, decisions that districts make about how to apply their federal dollars will show up in the school-by-school financial reports. Districts will want to consider how their investments impact different schools with an eye toward equity.

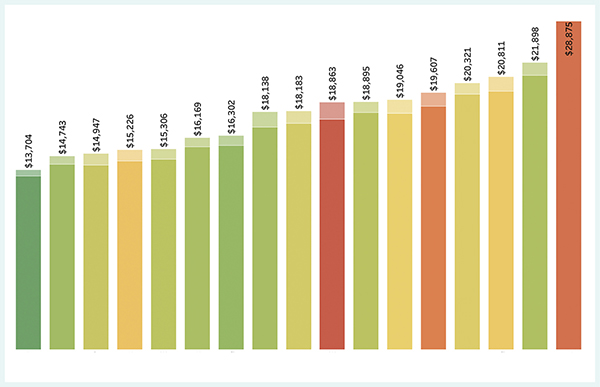

The accompanying graph uses those new school-by-school financials to show an East Coast school district’s spending per pupil for each of its elementary schools in 2018-19.

Perhaps more importantly is a first-ever equity provision attached to the federal relief funds, namely the Maintenance of Equity requirement. Not to be confused with the Maintenance of Effort provision, this new equity requirement applies to school districts with more than 1,000 students and specifies that if districts make cuts in the 2022 and 2023 school years, they must not make larger cuts per pupil to higher-poverty schools.

Another part of the provision prohibits disproportionate cuts to staffing in each district’s highest-poverty schools. In this case, a school is considered higher poverty if it is in the district’s top quartile of schools with respect to poverty concentration. This new equity requirement means that districts will need to watch carefully how decisions on hiring, staffing or even layoffs impact the finances at various schools.

Author

Additional Resources

A few informational resources on spending the new federal funds on local schools.

- Edunomics Lab series of 30-minute, interactive webinars to help districts decide how to use new federal relief dollars effectively while avoiding long-term spending obligations.

- A presentation by Edunomic Lab’s Marguerite Roza on how districts can make the most of federal funds.

- A national survey of parents by the Walton Family Foundation on using federal relief funds to best benefit their school-age children.

- A Chiefs for Change planning tool that offers a starting point for multiyear planning.

- K-12 Leaders’ Guide to Successful Technology Integration, produced by Digital Promise, that shares lessons from seven years of implementing the Verizon Innovative Learning Schools program, which provides technology, internet access, professional learning and support to hundreds of Title I schools nationwide.

Five Principles to Guide Spending Decisions

Unlike most federal dollars, the federal relief funds from the American Rescue Plan are highly flexible. But with flexibility comes great responsibility to get it right. Toward that end, here are five key principles to guide district spending decisions:

- Commit to a multiyear spending plan.

Avoid adding new recurring costs to avert a disruptive fiscal cliff. Maintain a long-term financial forecast. - Seek targeted investments to increase learning time for students who need it most.

Be creative about adding more time for students where appropriate. Focus those investments on students who are struggling academically. - Consider how equitably funds are applied across schools.

Compute dollars per student for each school. - Honor the promise to taxpayers to focus on students and relief.

Compute the per-student costs or cost per extra student hour to ensure spending is reasonable. Find ways to measure effects on students and ensure success. Be nimble and adjust plans as needed. - Be transparent and ensure broad participation in spending decisions.

Engage parents, communities and especially boards on spending choices. Invite principal feedback on whether investments match the needs of their students. Apply proper procurement protocols. Publicly share all investments, providers and intended benefits.

Advertisement

Advertisement

Advertisement

Advertisement

.png?sfvrsn=dde77dc7_3)