The Leading Edge: Policy & Advocacy Blog

The Leading Edge, AASA's policy & advocacy blog, provides up-to-date information about activities in Washington, D.C. and Capitol Hill that affect you and your school district.

The Leading Edge, AASA's policy & advocacy blog, provides up-to-date information about activities in Washington, D.C. and Capitol Hill that affect you and your school district.

Topics include new or proposed regulations and federal policies, federal funding updates and opportunities, advocacy resources and more.

Latest Posts

-

May 07, 2024

OCR Releases New Guidance on Title IVToday, the Biden administration released new OCR guidance to help school leaders navigate what constitutes antisemitic discrimination of students and other Title VI violations.

-

May 06, 2024

FAFSA Resources from USEDIn addition to the FAFSA resources published last week, we are posting more from the U.S. Department of Education to assist districts.

-

May 06, 2024

Guest Post: Comparing Requirements for Schools Under E-Rate & KOSMAThis blog post is cross posted from the Public Interest Privacy Center about Kids Off Social Media Act (KOSMA) introduced on May 1.

-

May 02, 2024

Additional Resources for FAFSA CompletionWe have a myriad resources from USED for schools, educators, families and students, as well as engaged in direct Q&A with members to address specific situations and provide additional feedback.

-

May 01, 2024

AASA Sends FY25 Funding Priorities to CongressToday, AASA sent a letter to Congressional appropriations leadership outlining our funding priorities.

-

April 30, 2024

The Advocate May 2024: April Was a Regulatory FrenzyThis month's edition of The Advocate is all about the regulatory frenzy at federal agencies.

-

April 25, 2024

New AI Policy Resource and WebinarLeading education and policy organizations in the TeachAI initiative (including AASA) have released a new resource for educators and leaders to address AI in teaching and learning.

-

April 25, 2024

Department of Labor Releases Final Overtime Rule: What It Means for DistrictsEarlier this week, the Department of Labor issued its final rule altering the overtime regulations under the Fair Labor Standards Act.

-

April 24, 2024

USDA Releases Final Rule on Child Nutrition StandardsUSDA has released the final rule on child nutrition standards. Here's what you need to know.

-

April 19, 2024

PSLF and TEACH Grant Servicer ChangeThe Dept. of Education is making changes to the servicing of PSLF and TEACH grants that may impact some educators.

-

April 19, 2024

New Title IX Regulations Finalized- Effective Aug 1The U.S. Department of Education released revisions to Title IX on April 19, 2024. The amended Title IX regulations, which will be effective on August 1, 2024.

-

April 16, 2024

Making the Most of Your Summer Fun(ds)—Creating Connections with Students and FamiliesThis is the eleventh installment of the Summer Funds series with AASA President Gladys Cruz.

-

April 16, 2024

AASA Joins National Organizations Endorsing COPPA 2.0AASA is pleased to endorse COPPA 2.0, as introduced by Senator Markey and others.

-

April 15, 2024

AASA Co-Hosts School Safety Briefing on Capitol HillOn Thursday, AASA was proud to co-sponsor “Smart School Safety: How Schools and Congress Can Maximize Investments for Kids” along with Sandy Hook Promise and the National Association of School Psychologists.

-

April 15, 2024

FAFSA Office HoursAs part of the FAFSA Week of Action (April 15 - 19), USED invites you to join USED staff for an office hours session for counselors, principals, school administrators, and school board members.

Latest Advocacy & Policy Resources

-

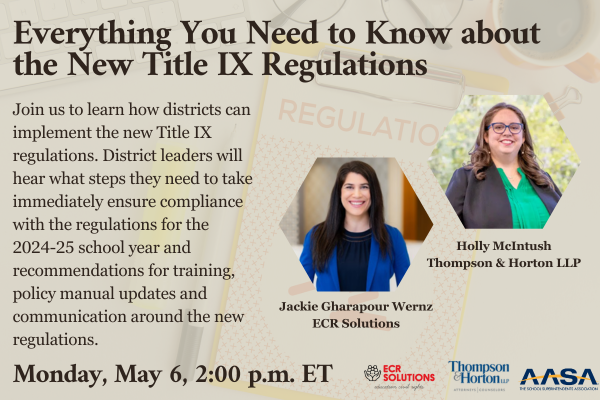

May 06, 2024

Everything You Need to Know about New Title IX RegulationsType:Webinar Recording Topics: Advocacy & PolicyJoin us to learn how districts can implement the new Title IX Regulations. -

April 19, 2024

Superintendent Letter to Community Regarding 2024 Title IX RulesTopics: Advocacy & Policy, District & School OperationsUse this template letter to communicate to families in your district about changes to the Title IX Rules from the U.S. Department of Education. -

April 19, 2024

The 2024 Title IX Regulations - What Superintendents Need To KnowTopics: Advocacy & Policy, District & School OperationsYour AASA Advocacy team, Thompson and Horton LLP and ECR Solutions has created a helpful document of changes to the 2024 Title IX Regulations released on April 19.

Receive legislative and regulatory actions direct to your inbox

Stay updated on the issues that matter most to you and understand how they could affect you, your district, your students and your community.